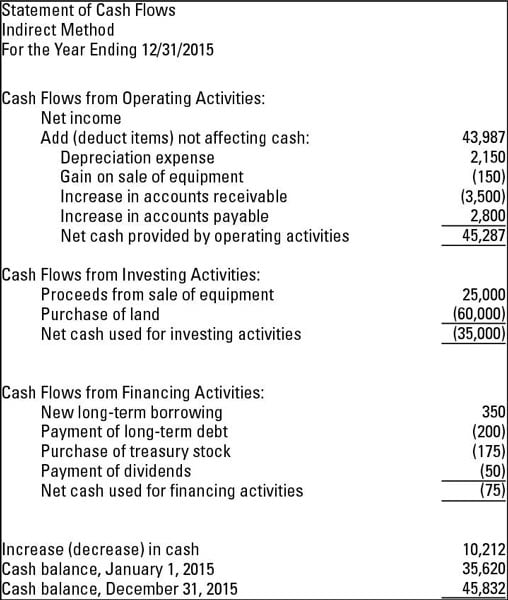

For example, there are many different templates that include a cash flow statement indirect method format in Excel. There are a broad range of online tools that can help you produce a cash flow statement. Cash flow statement indirect method format in Excel To see what the indirect method of cash flow looks like when you put all that information together, AccountingTools have produced an example of a statement generated using the indirect method, and there are many other examples and templates available online that you can explore at your leisure. After you’ve made all these cash flow statement indirect method adjustments, you’ll have the total amount of cash from operating expenses.

In short, increases in liabilities must be added back into income, not subtracted. This step can be especially tricky, as liabilities have a credit balance, rather than a debit balance. Some of the accounts that you’ll need to consider include accounts payable and accrued expenses. For example, if an asset increases during the recording period, cash has left your business, so the increase needs to be subtracted from your net income.Īccount for liabilities – Finally, you’ll need to adjust your net income for changes in your liability accounts.

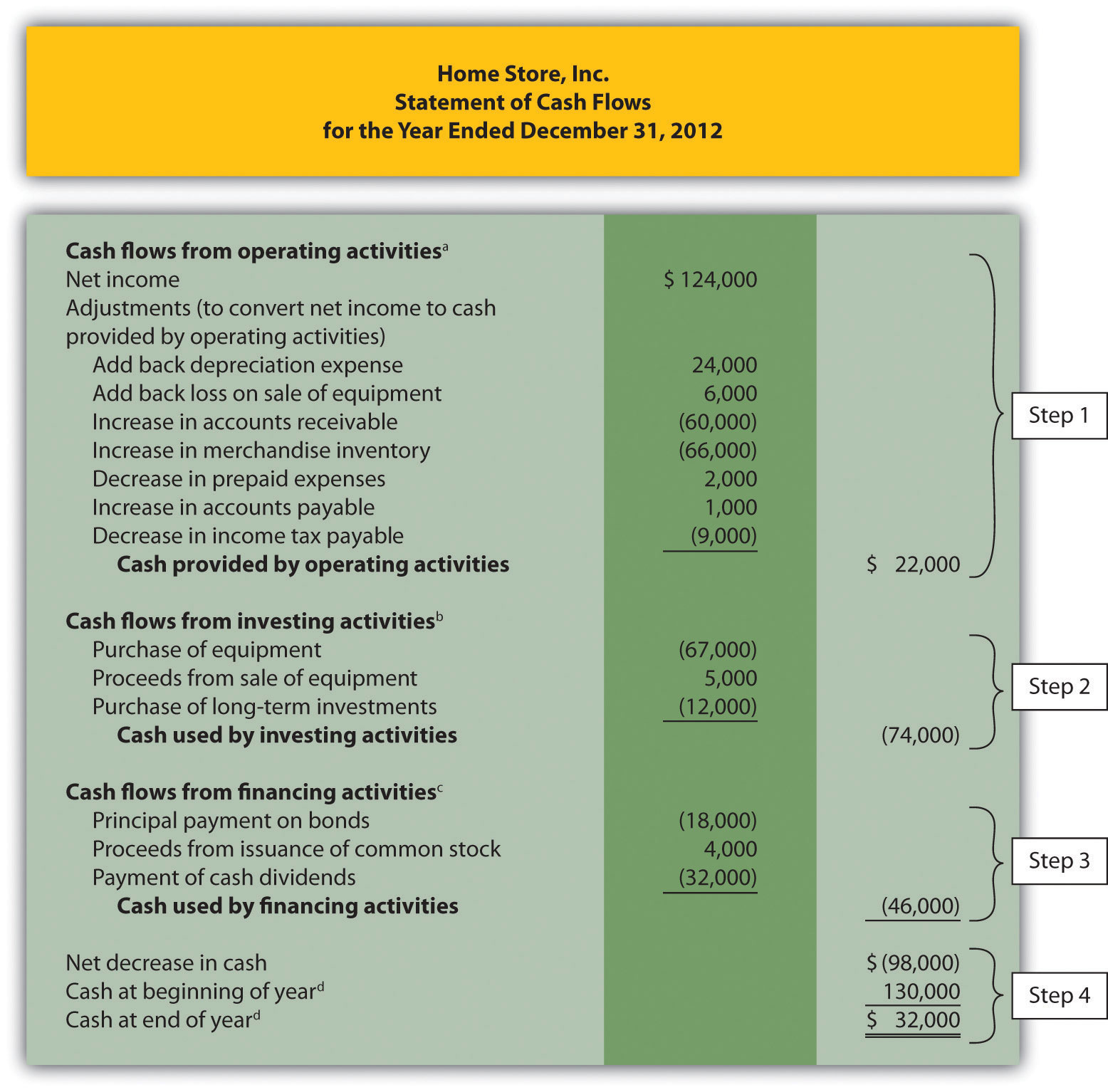

At this point, you’ll need to calculate how these changes affect cash to work out which way your net income should be adjusted. Some of these accounts include inventory, prepaid expenses, and accounts receivable. Non-cash expenses can include items like depreciation, amortization, and depletion.Īdjust your net income – Then, you’ll need to adjust your net income for changes in asset accounts that may have affected your company’s cash. Set up the statement – When you’re calculating cash flow using the indirect method, you’ll start by recording the net income for a given period, before subtracting or adding non-cash expenses, losses, and gains.

#INDIRECT METHOD CASH FLOW EXAMPLE HOW TO#

It’s much easier to understand the indirect method of cash flow by looking at how to prepare a cash flow statement in depth: How to prepare a cash flow statement using the indirect method By contrast, the direct method lists all your business’s cash inflows and outflows during the reporting period, thereby allowing you to calculate your net cash flow from your business’s operating activities. Put simply, any changes in asset and liability accounts that may affect your cash balances throughout the reporting period are added or subtracted from your net income at the beginning of the period, providing your operating cash flow. The indirect method uses changes in your balance sheet accounts to calculate cash flow from operating activities. There are two ways to generate a cash flow statement: the direct method and the indirect method. What is the indirect method of cash flow? Check out our comprehensive guide to find out more about the cash flow statement indirect method and get a little more information about the direct method vs. Both methods provide you with the same result, but their methodology differs in several significant ways. When you need to prepare a cash flow statement, there are two options – direct method or indirect method.

0 kommentar(er)

0 kommentar(er)